What About the Endowment?

With such a significant endowment, it’s reasonable to wonder why Stanford can’t spend more. The endowment makes amazing things possible, but there are limits on how it can be used.

The endowment does not sit idle. Every dollar is at work, funding about 20 percent of Stanford’s operating expenses every year.

Endowment is defined as assets invested to generate a steady stream of funding year after year, in perpetuity. Over the course of each year, Stanford draws down a portion of the endowment to support its operating expenses.

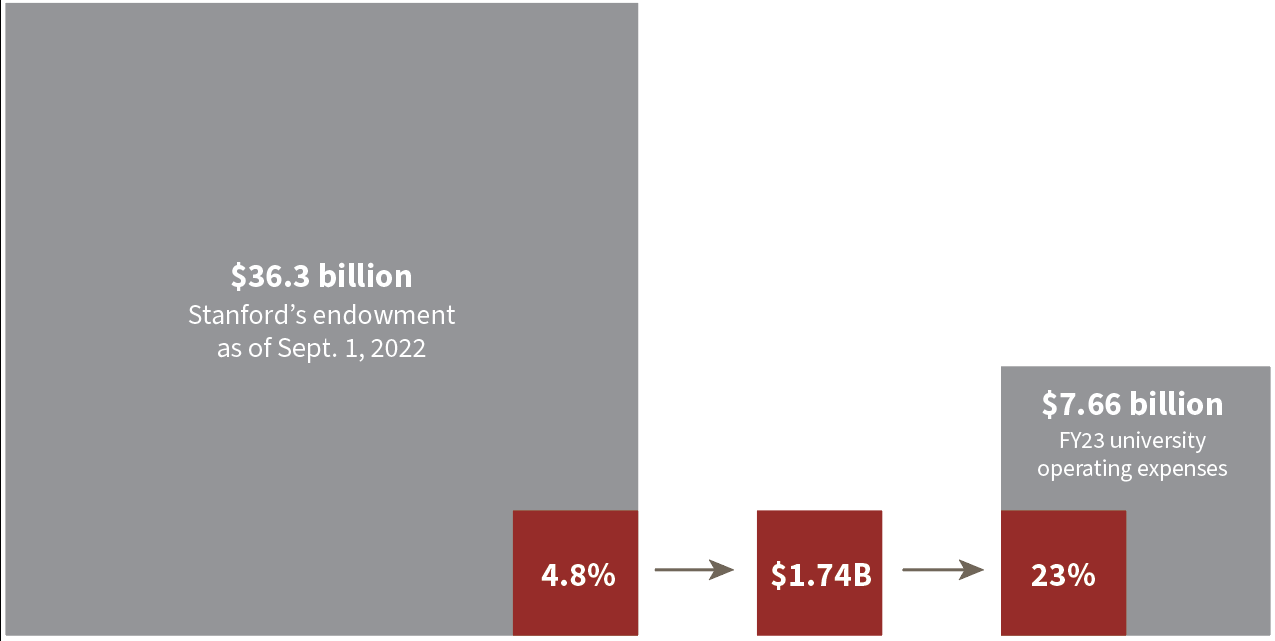

For example, at the beginning of fiscal year 2022–23, Stanford’s endowment was valued at $36.3 billion. The endowment payout of $1.74 billion (4.8% of the endowment’s value) covered about 23 percent of the university’s operating expenses of $7.66 billion.

Spending approximately 5 percent of the endowment each year typically covers about 20 percent of Stanford’s annual operating expenses.

This payout helps to support nearly every part of the university—more than 17,000 students, 2,300 faculty members, approximately 2,500 postdoctoral scholars, seven schools, and dozens of centers, institutes, and programs.

Why 5 percent?

Like most colleges and universities, Stanford aims to pay out around 5 percent of its endowment each year. This target payout rate is based on expected long-term average investment returns, minus inflation. Ideally, the annual payout from each endowment fund will remain steady or grow slightly over time, adjusted for inflation.

The university adjusts the payout every year to smooth the impact of market volatility and stay close to the target rate, which is the maximum that is safe and sustainable in perpetuity. If the payout were to exceed this rate by even 1 percentage point for a prolonged period, the endowment’s real value could decline, in which case the payout would cover an even smaller portion of Stanford’s budget.

Other restrictions on endowment spending

The endowment actually includes almost 8,000 different funds established by donors. Most of these are designated for specific purposes, such as supporting first-generation college students or advancing a particular field of study. Stanford has a legal and fiduciary obligation to use these funds as intended.

For example, payout from the endowment is the largest source of undergraduate and graduate student financial aid. Stanford is one of the few institutions that commits to meeting the demonstrated need of undergraduate students through scholarships—not loans.

Annual giving is also crucial

If the endowment continues to be spent at a sustainable rate, then it can provide that support forever. Annual gifts help fill the gap between the endowment payout and the university’s expenses.

Annual gifts tend to be less restricted than endowed funds and can usually be expended completely in the year they are received. This flexibility is enormously helpful in meeting needs when they arise and piecing together the operating budget.

Approximately 55,000 households make gifts to Stanford each year. The combination of endowment and annual giving makes it possible for Stanford to have impact – and for every member of the Stanford community to make a difference.

It’s the income generated from investing the endowment, not the endowment principal itself, that supports our annual operating budget. If we start to consume the endowment principal, there will be less to invest and therefore less income to support the university in future years.

Randy Livingston, ’75, MBA ’79,

Stanford’s vice president for business affairs and CFO